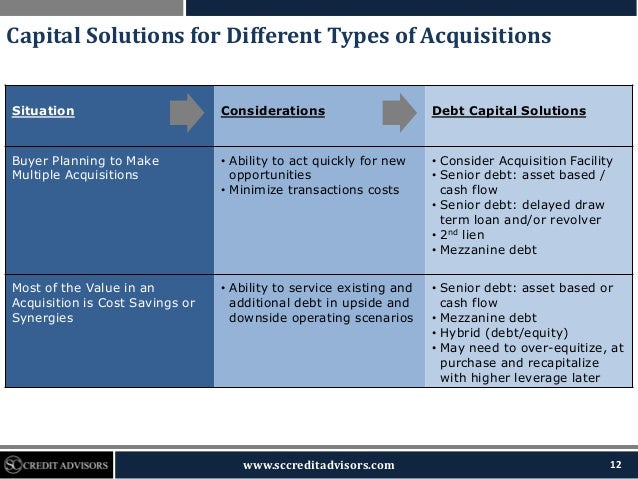

Maturity, amortization and size), new incremental lenders generally inherit the. • term loans • 1% amortization • accordion functionality • delayed draw term loans • up to 50% of the commitment • flexible permitted acquisition parameters • equity co‐investments investment criteria • ebitda of greater than $3mm • private equity ownership • stable & growing cash flow profile • niche businesses

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Amortization loans spread the principal payments more evenly, distributing the burden over the entire course of a loan's life.

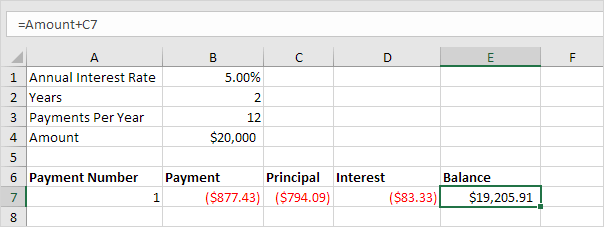

Delayed draw term loan amortization. $3,125,000 plus 1.250% of the delayed draw term loan advance. Article, term loans and high yield bonds: For a term of fifteen years, if the payment frequency is biweekly, you need to enter 390 for the number of payments.

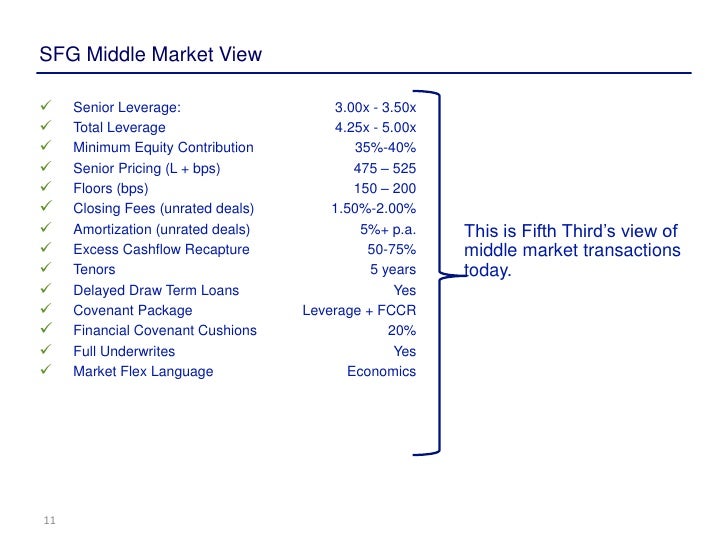

Commencing on the bank term loan amortization date, borrower shall make twenty seven (27) equal monthly payments of principal and interest which would fully amortize the outstanding bank term loan as of the bank term loan amortization date over the bank term loan repayment period and continuing thereafter during the bank term loan repayment period. The initial term loans and delayed draw term loans amortize at a rate of 1.00% of the aggregate principal amount of initial term loans and delayed draw term loans outstanding, payable quarterly. It does not include interest.

If a reporting entity borrows a portion of the debt, only a proportionate amount of the commitment fee asset should be recognized as debt discount. The payment frequency setting also impacts the loan's term. This amortization rate is a significant improvement from the prior credit agreement, decreasing from 5.00% in the prior credit agreement to 1.00% pursuant to the new.

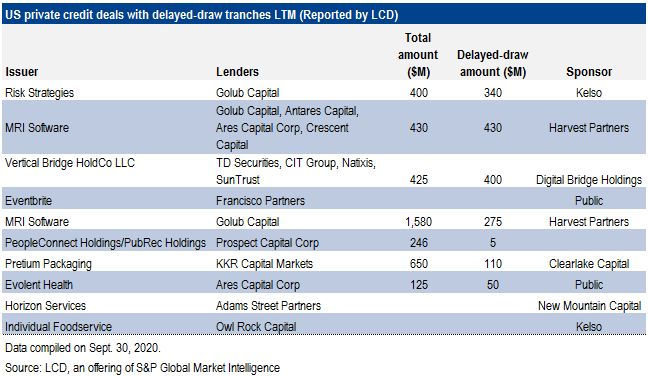

Ddtls were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity (often for future acquisitions or expansions) but wanted to delay the incurrence of the additional debt. = $10,000 (annual) $10,000.00/12 (first month) repayment time : $3,125,000 plus 1.250% of the delayed.

This discount should be amortized over the term of the debt. The withdrawal periods—such as every. Covenants tailored to specific client needs

Like i stated earlier, it is advisable to draw a loan amortization schedule in order to put the many details in clear format. Term loan b allows borrowers to defer repayment of a large portion of the loan, but is more costly to borrowers than term loan a. $3,125,000 plus 1.250% of the delayed draw term loan advance.

Where the borrower has both first and second lien secured term loan facilities, Collateralized loan obligations (clos), the largest segment of the The principal amount of the delayed draw term loan shall be repaid in twelve (12) consecutive quarterly installments equal to the product of the percentages set forth below multiplied by the outstanding principal amount of the delayed draw term loan on the second anniversary of the closing date, unless accelerated sooner pursuant to section 9.2:

Their appeal is one reason borrowers have moved toward the private debt market, sometimes at the expense of syndicated loans. $3,125,000 plus 1.250% of the delayed draw term loan advance. One peculiar change that will happen as the months.

Balloon loans, or bullet loans, operate. As final amortized payments near, borrowers are not subject to balloon payments or other irregularities. See fg 3.4.13 for information on debt modification or exchange on delayed draw term loan.

(a) upon the terms and conditions set forth in this agreement and in reliance upon the representations and warranties of the borrower herein set forth, the lender agrees to make (a) a loan to the borrower on the closing date in the principal amount of $16,295,500 and (b) a loan to the borrower after the closing date and prior to the commitment termination date in a. $3,125,000 plus 1.250% of the delayed draw term loan advance. 3.4.13 delayed draw term loan when a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender, we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10% test since the commitment is not funded on the modification date.

/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

Amortized Loan Definition

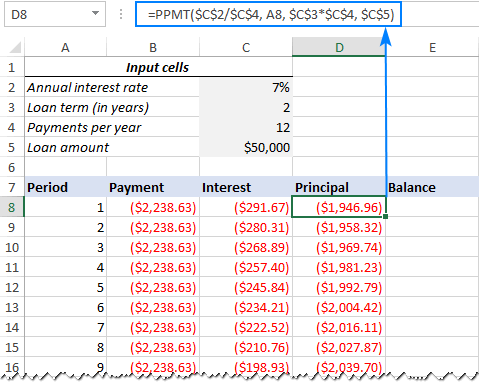

Loan Amortization Schedule In Excel In Easy Steps

Capital Markets Looking At The Bank Loan Syndication

Pandemic Leads Lenders To Tighten Rules On Delayed-draw Term Loans Sp Global Market Intelligence

Financing Acquisitions Using Debt Capital

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

2

Txu And The Maturity Wall A Back-of-the-envelope Analysis Leveraged Commentary Data

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed - Ablebitscom

The Thawing Of The Credit Markets

Execution Version Deal Cusip 19933mae3 Revolving Loan Cusip 19933maf Law Insider

Exhibit102q12017

Fed Announces Framework Of The Main Street Lending Program Bakerhostetler - Jdsupra

Update 1 Pg Term Loan Pricing Lowered - Reorg

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed - Ablebitscom

Exploring The Pros Cons Of 1l2l Vs Unitranche Financing Structures Penfund

Advanced Lbo Modeling Test 4 Hour Example Excel Template - Wall Street Prep

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed - Ablebitscom

Debt Schedule Video Tutorial And Excel Example